Medical Services

Medical services for Trust participants are provided through the Aetna Choice POS II Plan. This type of plan allows you to visit both in-network and out-of-network doctors and hospitals. You can visit any doctor you want and do not need to get a referral, but out-of-network doctors and hospitals will be more expensive than in-network doctors and hospitals.

Medicine & Prescriptions

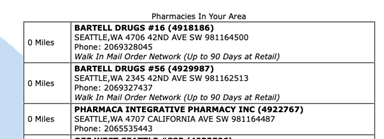

UNITE HERE Northwest Trust Funds works with Sav-Rx to provide cost effective prescription drug coverage.

Dental

Vision

Vision coverage is provided through EyeMed Access Network. To receive maximum benefits, it is to your advantage to see an EyeMed member doctor. However, you may choose to use an out-of-network provider. In this case, you must pay for the services at the time you receive them and then file a claim with EyeMed. You will be reimbursed up to the scheduled amounts listed on the Vision Benefit Highlights flyer [PDF].

Member Assistance Program (MAP)

The MAP is here to help when you are facing issues that interfere with your health, well-being, and productivity at home or at work. Member Assistance Program flyer [PDF]

Your free, confidential MAP program is available 24/7 and offers 5 face-to-face visits (no co-pay, deductible or premium) with a qualified clinical expert. The program is available to spouses, domestic partners, and children up to age 26.

Weekly Disability

Weekly Disability benefits are payable to active employees if you are totally disabled as the result of a non-occupational injury or illness (including pregnancy-related condition).

Long-term Disability Insurance

Life Insurance & AD&D

Your plan covers Life Insurance and Accidental Death and Dismemberment benefits.

Early Retiree Health Benefits Program

Retiring before age 65? You may be planning to retire early or you may need to retire earlier than anticipated. Despite good planning, if you retire early, you may have gap years, which could result in a scramble to find affordable, quality health care coverage until you are eligible for Medicare at age 65. To help you bridge the gap between early retirement and Medicare, the Trustees have implemented an Early Retiree Health Benefits Program to ensure you will have access to the same Trust health coverage you have come to rely on.

What this means to you:

Under the program, Trust participants who meet the following requirements will be eligible to enroll in the Early Retiree Health Benefits Program:

- are at least age 55

- are retired

- have at least twenty (20) years of service or the equivalent number of months (240) as a participant in the UNITE HERE Northwest Health Trust Fund

- have exhausted their continuation coverage under COBRA (18 months)

Participants enrolled in the Early Retiree Health Benefits Program will make self-payments to the Trust at the same rate and benefits as their prior COBRA coverage and will have coverage under this program up to the month before they turn age 65, consistent with Medicare’s enrollment rules. Once on the program, participants will be able to remain on the program until reaching Medicare age.

If you have questions about this new program or to find out if you are eligible to enroll, call the Trust Administration Office at (844) 411-0786

Medicare Eligibility Consulting Services

If you are thinking of retiring and want to know what your health insurance options are, let a highly trained expert help guide you. The Trust provides Medicare Eligibility Consulting to help you determine whether you are eligible for Medicare, and what your options are if you are not eligible. See Medicare Eligibility Consulting flyer [PDF] for more information.

Pension Plan

The purpose of the Western UNITE HERE and Employers Pension Fund is to provide you with a source of regular income when you retire. The plan sends retirees a monthly check (called a pension) starting at retirement, typically age 65, and lasting until death. You can download a copy of the Pension Summary Plan Description [PDF] for details on the Pension Plan.